- Microsoft quarterly revenue up 17% to $81.3 billion, Microsoft Cloud revenue is 63% of this

- Investors are worried about over reliance on AI model makers, OpenAI and CapEx

- Nvidia still plays a role in Microsoft's plans going forward

Microsoft has posted a 17% year-over-year increase in quarterly revenue ($81.3 billion), but despite this success, it seems investors are concerned about bigger things at play than just the company's finances.

Share prices actually dropped 6% in after-hours trading, with investors likely worried about Microsoft's heavy reliance on AI model makers and huge capital spending.

And despite Microsoft forfeiting its right of first refusal as OpenAI's compute provider, the company is still heavily tied to the ChatGPT maker in more ways than one, which adds to the pressure it faces in gaining investor confidence.

Microsoft revenue up, but share prices down

In its earnings release, Microsoft admitted that its commercial remaining performance obligation increased 110% to $625 billion.

Nearly half (45%) of this is tied to OpenAI after OpenAI set out plans to buy an additional $250 billion in Azure services, with Microsoft CFO Amy Hood stressing the remaining 55% of its backlog is spread across various industries, geographies and customers, and is unrelated to OpenAI.

Still, Hood praised Microsoft Cloud's performance, which has now hit the $50 billion mark in quarterly revenue - in other words, the department is now responsible for nearly two-thirds (63%) of the entire company's revenue.

“We are only at the beginning phases of AI diffusion and already Microsoft has built an AI business that is larger than some of our biggest franchises," CEO Satya Nadella declared. “We are pushing the frontier across our entire AI stack to drive new value for our customers and partners.”

During its most recent quarter, Microsoft's CapEx reached $37.5 billion, or nearly half (46%) of its entire revenue, with an estimated two-thirds spend on GPUs and CPUs, Hood explained in the call.

Microsoft also implied a continued reliance on Nvidia chips despite in-house efforts with its own Maia hardware. Nvidia shares have plateaued in recent weeks over concerns of an impending AI bubble pop and increased activity by its customers producing their own chips.

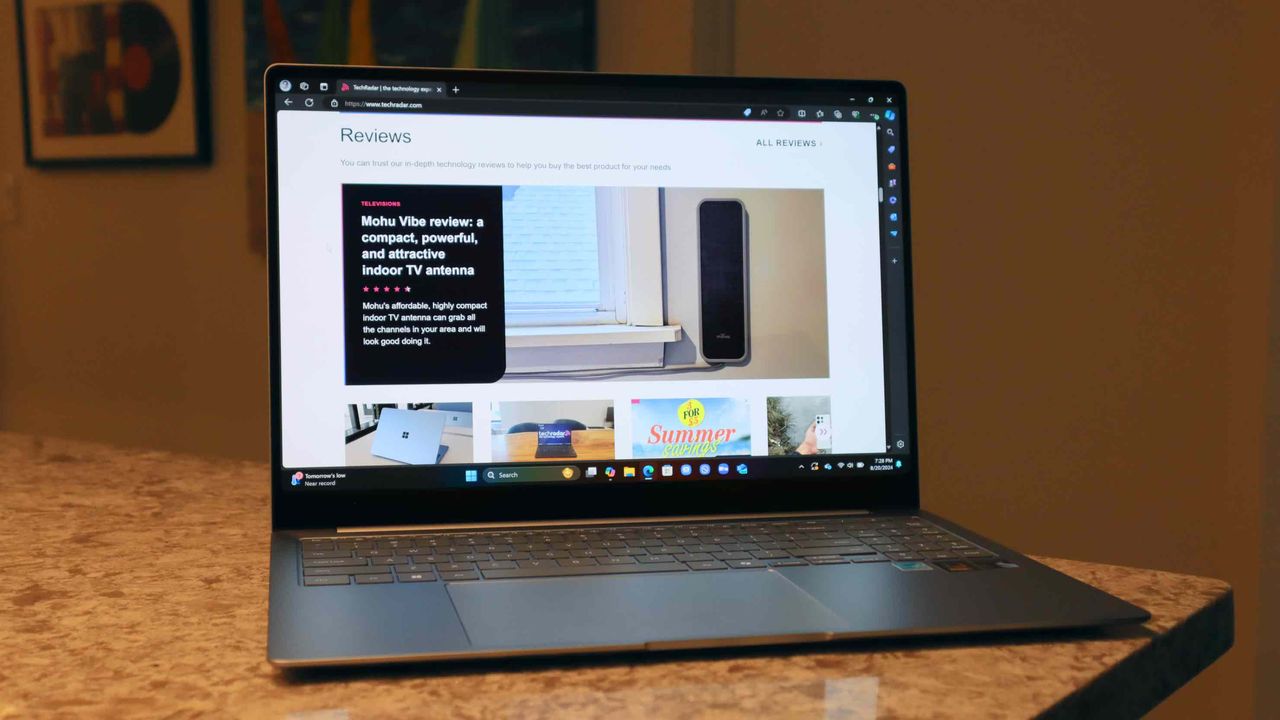

Follow TechRadar on Google News and add us as a preferred source to get our expert news, reviews, and opinion in your feeds. Make sure to click the Follow button!

And of course you can also follow TechRadar on TikTok for news, reviews, unboxings in video form, and get regular updates from us on WhatsApp too.

Source: TechRadar